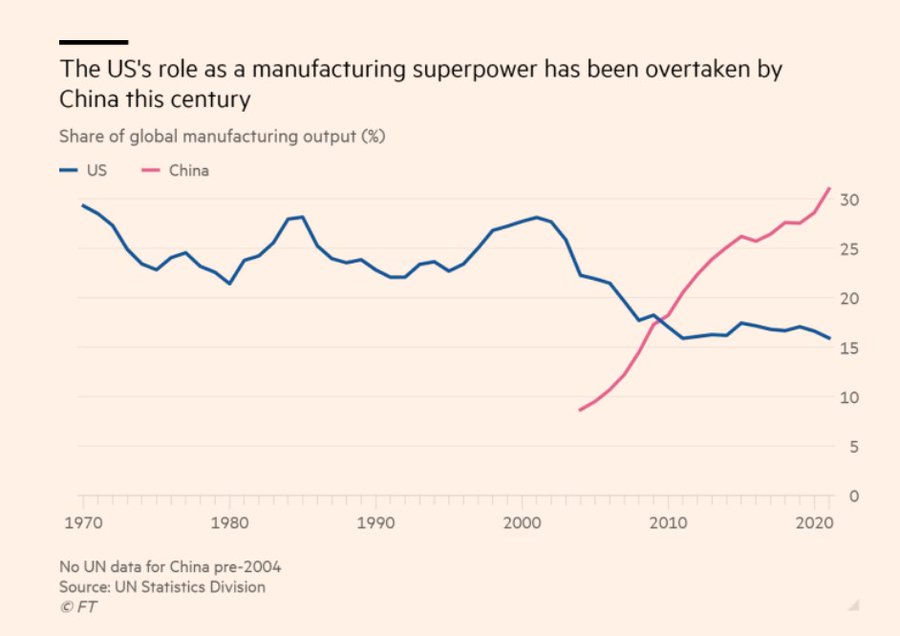

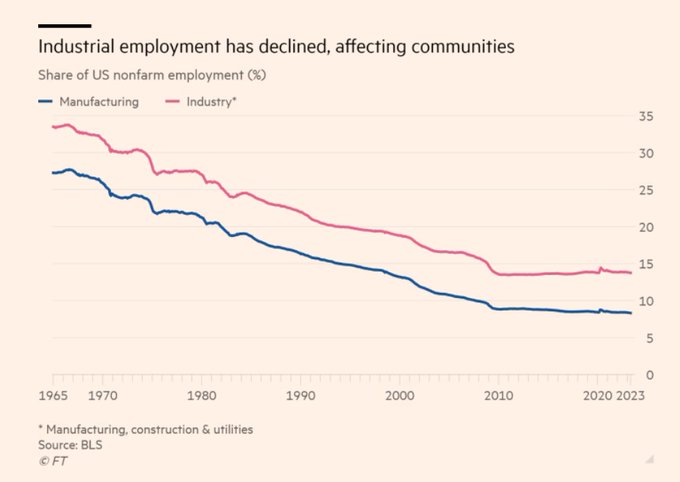

The US voluntarily de-industrialized and financialized its economy, so corporations could make more profits by outsourcing manufacturing jobs to China, to exploit workers with lower wages.

Now China has become the world's manufacturing superpower, training highly skilled workers, significantly raising their living standards, and building its own local industries, which are out-competing many US corporations.

So the US instead changes the rules of its beloved "rules-based order", imposing sanctions and waging economic war on Chinese companies.

Meanwhile, Washington blames Beijing for this reversal, ignoring how the USA's own polices of de-industrialization, financialization, and outsourcing destroyed its industrial base.

As the Financial Times puts it in this article, "America is feeling buyer’s remorse at the world it built": ft.com/content/77faa2

Tweet vertalen

1 opmerking:

Besides that, the U.S. built up a huge pile of debt due to being the issuer of the "world reserve currency".

Michael Hudson states that (in line with the "Triffin Dilemma) only a country that imports more than it exports CAN be the issuer of that currency. The country will have to issue government bonds (Treasuries) , which the countries that export more than they import will naturally buy, to store away safely their surplusses. This way it also finances the U.S. military bases around the world.

If countries start to believe that their national reserves , that are largely being held in dollars (Treasuries) , are no longer safe anymore because they can be confiscated (like the 300 billion of Russia) by the U.S. when they don't follow "the rules" , these countries will want to move away from the dollar. This trend is unfolding, and these countries have been increasing their holdings of physical gold.

This has all been foreseen for decades, and when the last GATT round was completed , it was done in full conscience of the fact that industries would move overseas and the U.S. would get deindustrialised.

Maybe a nice big war will wipe out all the debt!!!

Een reactie posten