How philanthropy benefits the super-rich

There are more philanthropists than ever before. Each year they give tens of billions to charitable causes. So how come inequality keeps rising? By Paul Vallely

Philanthropy, it is popularly supposed, transfers money from the rich to the poor. This is not the case. In the US, which statistics show to be the most philanthropic of nations, barely a fifth of the money donated by big givers goes to the poor. A lot goes to the arts, sports teams and other cultural pursuits, and half goes to education and healthcare. At first glance that seems to fit the popular profile of “giving to good causes”. But dig down a little.

The biggest donations in education in 2019 went to the elite universities and schools that the rich themselves had attended. In the UK, in the 10-year period to 2017, more than two-thirds of all millionaire donations – £4.79bn – went to higher education, and half of these went to just two universities: Oxford and Cambridge. When the rich and the middle classes give to schools, they give more to those attended by their own children than to those of the poor. British millionaires in that same decade gave £1.04bn to the arts, and just £222m to alleviating poverty.

The common assumption that philanthropy automatically results in a redistribution of money is wrong. A lot of elite philanthropy is about elite causes. Rather than making the world a better place, it largely reinforces the world as it is. Philanthropy very often favours the rich – and no one holds philanthropists to account for it.

The role of private philanthropy in international life has increased dramatically in the past two decades. Nearly three-quarters of the world’s 260,000 philanthropy foundations have been established in that time, and between them they control more than $1.5tn. The biggest givers are in the US, and the UK comes second. The scale of this giving is enormous. The Gates Foundation alone gave £5bn in 2018 – more than the foreign aid budget of the vast majority of countries.

Philanthropy is always an expression of power. Giving often depends on the personal whims of super-rich individuals. Sometimes these coincide with the priorities of society, but at other times they contradict or undermine them. Increasingly, questions have begun to be raised about the impact these mega-donations are having upon the priorities of society.

There are a number of tensions inherent in the relationship between philanthropy and democracy. For all the huge benefits modern philanthropy can bring, the sheer scale of contemporary giving can skew spending in areas such as education and healthcare, to the extent that it can overwhelm the priorities of democratically elected governments and local authorities.

Some of this influence is indirect. The philanthropy of Bill and Melinda Gates has brought huge benefits for humankind. When the foundation made its first big grant for malaria research, it nearly doubled the amount of money spent on the disease worldwide. It did the same with polio. Thanks in part to Gates (and others), some 2.5 billion children have been vaccinated against the disease, and global cases of polio have been cut by 99.9%. Polio has been virtually eradicated. Philanthropy has made good the failures of both the pharmaceutical industry and governments across the world. The Gates Foundation, since it began in 2000, has given away more than $45bn and saved millions of lives.

Yet this approach can be problematic. Bill Gates can become fixed on addressing a problem which is not seen as a priority by local people, in an area, for example, where polio is far from the biggest problem. He did something similar in his education philanthropy in the US where his fixation on class size diverted public spending away from the actual priorities of the local community.

Other philanthropists are more wilfully interventionist. Individuals such as Charles Koch on the right, or George Soros on the left, have succeeded in altering public policy. More than $10bn a year is devoted to such ideological persuasion in the US alone.

The result has been what the late German billionaire shipping magnate and philanthropist Peter Kramer called “a bad transfer of power”, from democratically elected politicians to billionaires, so that it is no longer “the state that determines what is good for the people, but rather the rich who decide”. The UN general assembly has warned governments and international organisations that, before taking money from rich donors, they should “assess the growing influence of major philanthropic foundations, and especially the Bill & Melinda Gates Foundation … and analyse the intended and unintended risks and side-effects of their activities”. Elected politicians, the UN warned in 2015, should be particularly concerned about “the unpredictable and insufficient financing of public goods, the lack of monitoring and accountability mechanisms, and the prevailing practice of applying business logic to the provision of public goods”.

Some kinds of philanthropy may have become not just non-democratic, but anti-democratic. Charles Koch and his late brother, David, are undoubtedly the most prominent example of rightwing philanthropy at work. But there are scores of others, most particularly in the US, who embrace causes which many find controversial and even distasteful. Art Pope has used the fortune he has amassed from his discount-store chain to push for a tightening of the law to prevent fraud in elections, even though such fraud is negligible in the US. Pope’s move, which would require voters to show ID at the polls, effectively disenfranchises the 10% of the electorate who lack photo ID because they are too poor to own a car and are unlikely to go to the expense of getting a driving licence simply to vote. Such voters – many of them black – are statistically unlikely to vote for the arch-conservatives that Art Pope smiles upon.

But do such philanthropic activities manipulate the democratic process any more than do the campaigns of the billionaire financier George Soros to promote accountable government and social reform around the world? Or hedge-fund billionaire Tom Steyer’s funding of a movement to encourage more young people to vote on climate change? Or the attacks by the internet billionaire Craig Newmark on fake news? In each case these rich individuals are motivated to intervene by something arising from their own lived experience. By what yardstick can we suggest that some are more legitimate than others?

David Callahan, the editor of the Inside Philanthropy website, puts it this way: “When donors hold views we detest, we tend to see them as unfairly tilting policy debates with their money. Yet when we like their causes, we often view them as heroically stepping forward to level the playing field against powerful special interests or backward public majorities … These sort of à la carte reactions don’t make a lot of sense. Really, the question should be whether we think it’s OK overall for any philanthropists to have so much power to advance their own vision of a better society.”

The idea that a philanthropist’s money is their own to do with as they please is deep-rooted. Some philosophers argue that each individual has full ownership rights over their resources – and that a rich person’s only responsibility is to use their resources wisely. John Rawls, one of the most influential philosophers of the 20th century, saw justice as a matter of fairness. He argued that citizens discharge their moral responsibility when they contribute their fair share of the taxes which governments use to take care of the poor and vulnerable. The better-off are then free to dispose of the rest of their income as they like.

But what the rich are giving away in their philanthropy is not entirely their own money. Tax relief adds the money of ordinary citizens to the causes chosen by rich individuals.

Most western governments offer generous tax incentives to encourage charitable giving. In England and Wales in 2019, an individual earning up to £50,000 a year paid 20% of it in income tax. For those earning more, anything between £50,000 and £150,000 was taxed at 40%, and anything above £150,000 was taxed at 45%. But gifts to registered charities are tax free. So a gift of £100 would cost the standard taxpayer only £80, with £20 being paid by the government. But the highest-rate taxpayer would need to pay out only £55, because the state would provide the other £45. Super-rich philanthropists, therefore, find themselves in a position where a large percentage of their gift is funded by the taxpayer. Thus it becomes far less clear whether the money philanthropists give away can rightfully be regarded as entirely their own. If taxpayers contribute part of the gift, why should they not have a say in which charity receives it?

In Britain, the total cost to the state of the various tax breaks to donors in 2012 was estimated by the Treasury at £3.64bn. Tax exemptions for charities have existed in the UK since income tax was introduced in 1799, though charities had been largely exempt from certain taxes since the Elizabethan age. Indeed, British tax relief is still largely confined to the categories of charity set out in the 1601 Charitable Uses Act, which lists four categories of charity: relief of poverty, advancement of education, promotion of religion, and “other purposes beneficial to the community”. There are even fewer limitations on bodies wishing to become tax-exempt charities in the US, beyond a requirement not to engage in party politics.

Both countries offer additional incentives where donations are made to endow a charitable foundation. This enables a philanthropist to escape liability for tax on the donation, yet also retain control over how the money is spent, within the constraints of charity law. The effect of this is often to give the wealthy control in matters that would otherwise be determined by the state.

Yet the priorities of plutocracy, rule by the rich, and democracy, rule by the people, often differ. The personal choices of the rich do not closely match the spending choices of democratically elected governments. A major research study from 2013 revealed that the richest 1% of Americans are considerably more rightwing than the public as a whole on issues of taxation, economic regulation and especially welfare programmes for the poor. Many of the richest 0.1% – individuals worth more than $40m – want to cut social security and healthcare. They are less supportive of a minimum wage than the rest of the population. They favour decreased government regulation of big corporations, pharmaceutical companies, Wall Street and the City of London.

“There is good reason to be concerned about the impact on democracy if these individuals are exerting influence through their philanthropy,” wrote Benjamin Page, the lead academic on the study. The disproportionate influence of the mega-wealthy may explain, it concluded, why certain public policies appear to deviate from what the majority of citizens want the government to do. The choices made by philanthropists tend to reinforce social inequalities rather than reduce them.

There is therefore a strong argument that the money donated by philanthropists might be put to better use if it were collected as taxes and spent according to the priorities of a democratically elected government. In which case, should the state be giving tax relief to philanthropists at all?

The case for tax reform – to abolish these subsidies entirely, or ensure the rich can claim no more than basic tax payers can – has been made from both the right and the left. Tax breaks distort market choices, argues a prominent libertarian, Daniel Mitchell, of the Cato Institute, a thinktank funded by the conservative philanthropist Charles Koch. At the other end of the political spectrum, Prof Fran Quigley, a human rights lawyer at Indiana University, argues that charitable tax deductions should be ended – to free up billions of dollars for increased public spending on “food stamps, unemployment compensation and housing assistance”. But they should also end because they bolster the morally dubious illusion that charity “constitutes an effective and adequate response to hunger, homelessness, and illness”.

Yet attempts by politicians to limit the amount of tax relief – let alone abolish it entirely – have met with public disapproval ever since William Gladstone tried to cut it in 1863. The same thing happened when the British government tried to address the issue in 2012. When chancellor George Osborne tried to limit the amount of tax relief the rich could claim on their giving, he provoked a mass outcry from philanthropists, the press and from charities. Similar attempts at reform by President Barack Obama in the US met the same fate.

An alternative solution might be to impose restrictions on the kind of causes for which tax exemptions can be claimed. At the last election, the Labour party under Jeremy Corbyn floated the idea of removing charitable statusfrom fee-paying schools. Others go further. “Donations to college football teams, opera companies and rare-bird sanctuaries are eligible for the same tax deduction as a donation to a homeless shelter,” complains Quigley. One of the most thoughtful contemporary defenders of philanthropy, Prof Rob Reich, director of the Center on Philanthropy and Civil Society at Stanford University, who has described philanthropy as “a form of power that is largely unaccountable, un-transparent, donor-directed, protected in perpetuity and lavishly tax advantaged”, sees the answer in restricting tax relief to a hierarchy of approved causes.

But who decides that hierarchy? The problem comes in finding a mechanism that would better align charitable giving with generally agreed conceptions of the common good. Of course, it could be left to the state. But as Rowan Williams, the former Archbishop of Canterbury, told me: “That’s giving the state a dangerously high level of discretion. The more the state takes on a role of moral scrutiny, the more I worry … and the history of the last 100 years ought to tell us that a hyper-activist state with lots of moral convictions is pretty bad for everybody.”

Others have seen the solution as simply increasing taxes on the mega-rich. When the Dutch economic historian Rutger Bregman was asked at Davos in 2019 how the world could prevent a social backlash rising from the growth of inequality, he replied: “The answer is very simple. Just stop talking about philanthropy. And start talking about taxes … Taxes, taxes, taxes. All the rest is bullshit, in my opinion.”

The idea of greater taxes on the rich is gaining purchase politically all over the world. During the Democratic party presidential primaries, several candidates set out proposals for raising taxes on the assets or income of the super-rich. The growing economic populism across Europe and in the US will increase that pressure. So will the need to increase public revenue to meet the cost of the coronavirus crisis.

A number of prominent philanthropists, including Warren Buffett and Bill Gates, have publicly backed the idea. “I’ve paid more taxes than any individual ever, and gladly so. I should pay more,” Gates has said. Buffett says “society is responsible for a very significant percentage of what I’ve earned”, so he has an obligation to give back to society. Another rich entrepreneur, Martin Rothenberg, founder of Syracuse Language Systems, spells out how public investment makes private fortunes possible. “My wealth is not only a product of my own hard work. It also resulted from a strong economy and lots of public investment, both in others and in me,” he said. The state had given him a good education. There were free libraries and museums for him to use. The government had provided a graduate scholarship. And while teaching at university he was supported by numerous research grants. All of this provided the foundation on which he built the company that made him rich.

All of this undermines the argument that the rich are entitled to keep their wealth because it is all a result of their hard work. Indeed, some overtly acknowledge the existence of this social contract. In the UK, Julian Richer, founder of the hi-fi chain Richer Sounds, transferred 60% of the ownership of his £9m company to his employees in a partnership trust in 2019. Asked why he had made this decision, he replied that the staff had demonstrated loyalty over four decades, so he was now “doing the right thing” because that way “I sleep better at night.”

The growth in philanthropy in recent decades has failed to curb the growth in social and economic inequality. “We should expect inequality to decrease somewhat as philanthropy increases … It has not,” writes Kevin Laskowski, a field associate at the National Committee for Responsive Philanthropy. Indeed, as Albert Ruesga, president and CEO of the Greater New Orleans Foundation, has noted, “the collective actions of 90,000+ foundations … after decades of work … have failed to alter the most basic conditions of the poor in the US.”

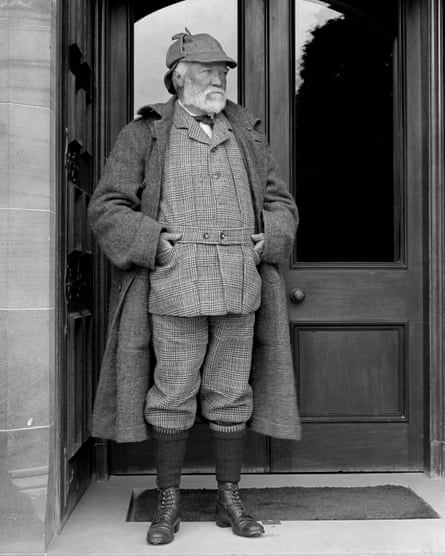

Why? The answer lies in the template that was established by the men who transformed modern philanthropy through the sheer scale of their giving in the late 19th and early 20th centuries. For all their munificence, the steel magnate Andrew Carnegie and the great industrial philanthropists of that era were notable – even in their own day – for avoiding the whole question of economic justice. Then, as now, a huge percentage of wealth was in the hands of a tiny few, almost completely untrammelled by tax and regulation. Carnegie and his fellows, their critics said, neglected the great ethical question of the day, which centred on “the distribution rather than the redistribution of wealth”. Carnegie, then the richest man in the world, was criticised in his day for distributing his unprecedented largesse because his fortune was built on ruthless tactics such as cutting the wages of his steel-workers. Carnegie’s greatest contemporary critic, William Jewett Tucker, concluded there is “no greater mistake … than that of trying to make charity do the work of justice”.

Carnegie built a network of nearly 3,000 libraries and other institutions to help the poor elevate their aspirations, but social justice was entirely absent from his agenda. More than that, he and his fellow “robber baron philanthropists” faced questions on the source of the money with which they were so generous – for it had been accumulated through business methods of a new ruthlessness. Like many of today’s tech titans, they amassed their vast fortunes through a relentless pursuit of monopolies. Teddy Roosevelt’s judgement on John D Rockefeller was that “no amount of charity in spending such fortunes can compensate in any way for the misconduct in acquiring them”. It is an insight that has found renewed traction in our times – as was shown by the ostracism of the Sackler family as leading international art philanthropists in 2019, and the boycotting of BP’s sponsorship by cultural leaders including the Royal Shakespeare Company. Roosevelt’s judgment on reputation-laundering through philanthropy is gaining new currency.

Philanthropy can be compatible with justice. But it requires a conscious effort on behalf of philanthropists to make it so. The default inclines in the opposite direction. Reinhold Niebuhr, in his 1932 book Moral Man and Immoral Society, suggests why: “Philanthropy combines genuine pity with the display of power [which] explains why the powerful are more inclined to be generous than to grant social justice.”

How can philanthropists break away from this default position? By nurturing the plurality of voices that are essential to hold both government and the free market to account. Philanthropy can even act as an agent of resistance, the American historian of philanthropy Benjamin Soskis suggested, immediately after the election of Donald Trump. “The fundamental liberal values, those of tolerance and respect for others, of decency, charity, and moderation, have been enfeebled in our public life,” Soskis said. “Philanthropy must be a place in which those values are preserved, defended, and championed.”

Philanthropy can recover a genuine sense of altruism only by understanding that it cannot do the job of either government or business. For it belongs not to the political or commercial realm, but to civil society and the world of social institutions that mediate between individuals, the market and the state. It is true that philanthropy can weaken elected governments, especially in the developing world, by bypassing national systems or declining to nurture them. And it can favour causes that only reflect the interests of the wealthy. But where philanthropists support community organisations, parent-teacher associations, co-operatives, faith groups, environmentalists or human rights activists – or where they give directly to charities that address inequality and specialise in advocacy for disadvantaged groups – they can help empower ordinary people to challenge authoritarian or overweening governments. In those circumstances, philanthropy can strengthen rather than weaken democracy.

But to do this, philanthropists need to be cannier about their analysis and tactics. At present, most philanthropists with concerns about disadvantage tend to focus on alleviating its symptoms rather than addressing its causes. They fund projects to feed the hungry, create jobs, build housing and improve services. But all that good work can be wiped out by public spending cuts, predatory lending or exploitative low levels of pay.

And there is a deeper problem. When it comes to addressing inequality, a well intentioned philanthropist might finance educational bursaries for children from disadvantaged backgrounds, or fund training schemes to equip low-paid workers for better jobs. That allows a few people to exit bad circumstances, but it leaves countless others stuck in under-performing schools or low-paid insecure work at the bottom of the labour market. Very few concerned philanthropists think of financing research or advocacy to address why so many schools are poor or so many jobs are exploitative. Such an approach, says David Callahan of Inside Philanthropy, is like “nurturing saplings while the forest is being cleared”.

By contrast, conservative philanthropists have, in the past two decades, operated at a different level. Their agenda has been to change public debate so that it is more accommodating of their neoliberal worldview, which opposes the regulation of finance, improvements in the minimum wage, checks on polluting industries and the establishment of universal healthcare. They fund climate change-denying academics, support free-market thinktanks, strike alliances with conservative religious groups, create populist TV and radio stations, and set up “enterprise institutes” inside universities, which allows them, not the universities, to select the academics.

Research by Callahan reveals that more liberal-minded philanthropists have never understood the importance of cultivating ideas to influence key public policy debates in the way conservatives have.

Only a few top philanthropic foundations – such as Ford, Kellogg and George Soros’ Open Society Foundations – give grants to groups working to empower the poor and disadvantaged in such areas. Most philanthropists see them as too political. Many of the new generation of big givers come out of a highly entrepreneurial business world, and are disinclined to back groups that challenge how capitalism operates. They are reluctant to back groups lobbying to promote the empowerment of the disadvantaged people whom these same philanthropists declare they intend to assist. They tend not to fund initiatives to change tax and fiscal policies that are tilted in favour of the wealthy, or to strengthen regulatory oversight of the financial industry, or to change corporate culture to favour greater sharing of the fruits of prosperity. They rarely think of investing in the media, legal and academic networks of key opinion-formers in order to shift social and corporate culture and redress the influence of conservative philanthropy.

Rightwing philanthropists have, for more than two decades, understood the need to work for social and political change. Mainstream philanthropists now need to awaken to this reality. Philanthropy need not be incompatible with democracy, but it takes work to ensure that is the case.

This is an edited extract from Philanthropy – from Aristotle to Zuckerberg by Paul Vallely, published by Bloomsbury on 17 September and available at guardianbookshop.com

• Follow the Long Read on Twitter at @gdnlongread, and sign up to the long read weekly email here.

https://www.theguardian.com/society/2020/sep/08/how-philanthropy-benefits-the-super-rich

Geen opmerkingen:

Een reactie posten