The Fed Won't Avert The Next "Crisis"... They Will Cause It

John Mauldin recently penned an interesting piece:

“Ignoring problems rarely solves them. You need to deal with them—not just the effects, but the underlying causes, or else they usually get worse. In the developed world, and especially the US, and even in China, our economic challenges are rapidly approaching that point. Things that would have been easily fixed a decade ago, or even five years ago, will soon be unsolvable by conventional means.Yes, we did indeed need the Federal Reserve to provide liquidity during the initial crisis. But after that, the Fed kept rates too low for too long, reinforcing the wealth and income disparities and creating new bubbles we will have to deal with in the not-too-distant future.This wasn’t a ‘beautiful deleveraging’ as you call it. It was the ugly creation of bubbles and misallocation of capital. The Fed shouldn’t have blown these bubbles in the first place.”

John is correct. The problem with low interest rates for so long is they have encouraged the misallocation of capital. We see it everywhere throughout the entirety of the financial system from consumer debt, to subprime auto-loans, to corporate leverage, and speculative greed.

Misallocation Of Capital – Everywhere

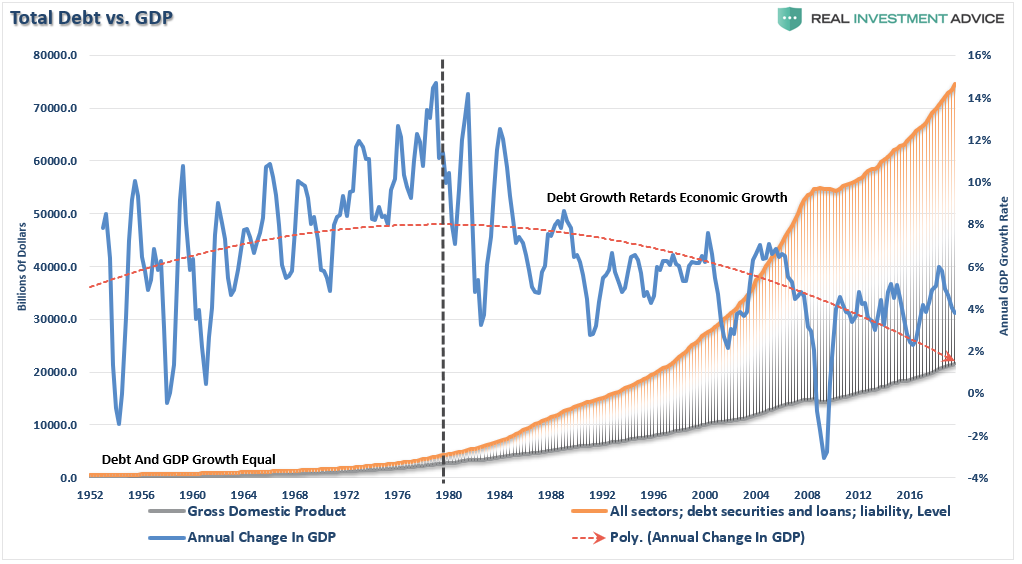

Debt, if used for productive purposes, can be beneficial. However, as discussed in The Economy Should Grow Faster Than Debt:

“Since the bulk of the debt issued by the U.S. has been squandered on increases in social welfare programs and debt service, there is a negative return on investment. Therefore, the larger the balance of debt becomes, the more economically destructive it is by diverting an ever-growing amount of dollars away from productive investments to service payments.”

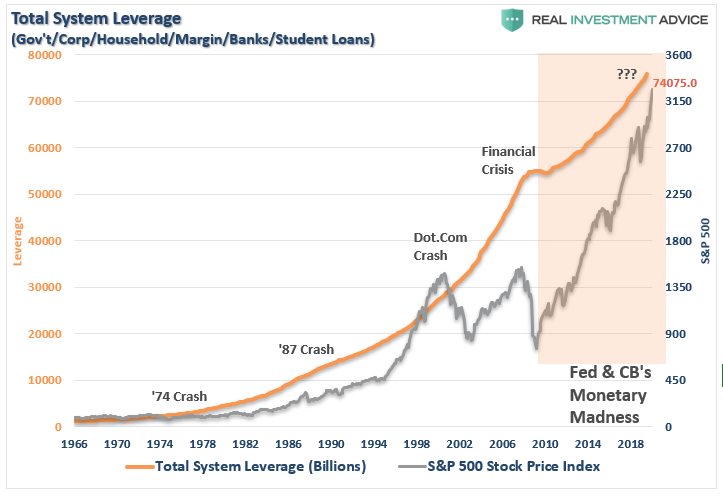

Currently, throughout the entire monetary ecosystem, there is a rising consensus that “debt doesn’t matter” as long as interest rates and inflation remain low. Of course, the ultra-low interest rate policy administered by the Federal Reserve is responsible for the “yield chase,” and the massive surge in debt since the “financial crisis.”

Yes, current economic growth is good, but not great. Inflation, and interest rates, remain low, which creates an “illusion” that using debt remains opportunistic. However, as stated, rising levels of non-productive debt has negative long-term economic consequences.

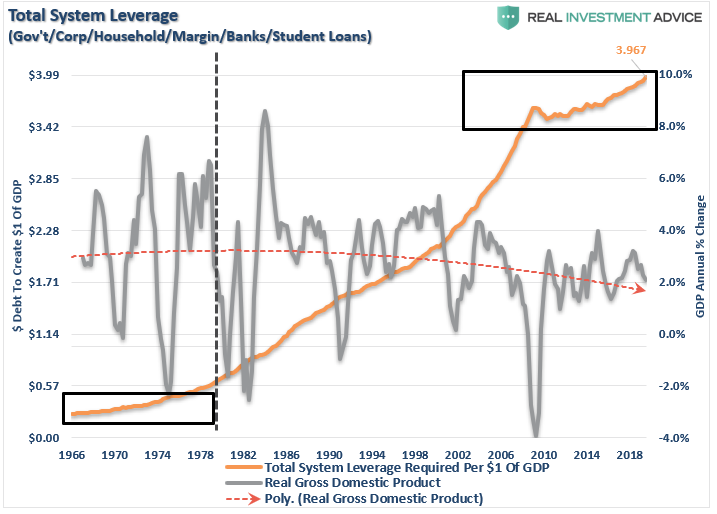

Before the deregulation of the financial industry under President Reagan, which led to an explosion in consumer credit issuance, it required just $1.00 of total system-wide debt to create $1.00 of economic growth. Today, it requires $3.97 to create the same $1 of economic growth. This shouldn’t be surprising, given that “debt” detracts from economic growth as the “debt service” diverts income from productive investments and leads to a “diminishing rate of return” for each new dollar of debt.

The irony is that while it appears the economy is growing, akin to the analogy of “boiling a frog,” we accept 2% economic growth as “strong,” whereas such growth rates were previously considered near recessionary.

Another conundrum is that corporations, and financial institutions, appear to be healthier, not to mention wealthier than ever. If such is indeed the case, then why is the Federal Reserve still needing to engage in “emergency monetary measures” to support the financial markets and economy after more than a decade?

As John stated above, the Fed’s actions are only “ignoring the problems” which, combined, is a problem too large for the Federal Reserve to fix.

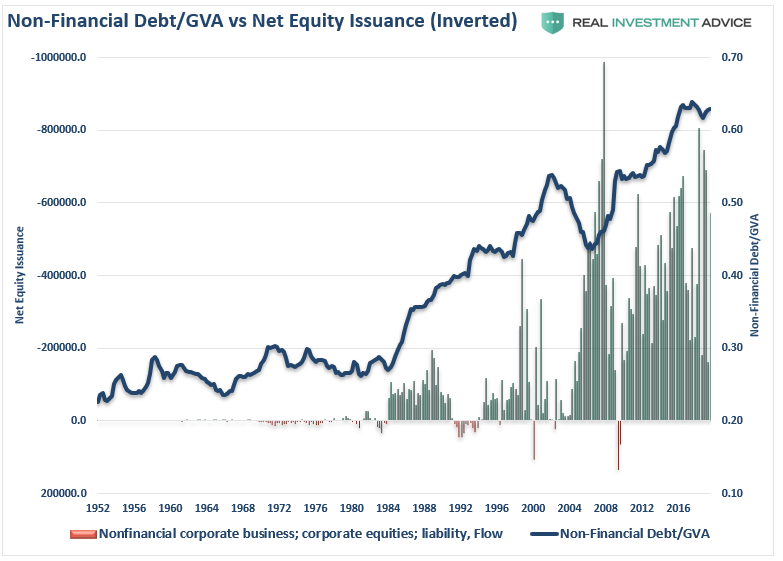

The Dark Side Of Stock Buybacks

While many argue that “share buybacks” are just a method by which corporations can return cash to shareholders, there is a dark side. In moderation, repurchases can be a beneficial method for a company to deploy capital when no better options are available. (It’s the least best use of cash.)

But, as with everything in life, when taken to “excess” the beneficial effects, can become detrimental.

“The rules now reward management, not for generating revenue, but to drive up the price of the share price, thus making their options and stock grants more valuable.” – John Mauldin

The problem for the Fed was, despite the best of intentions, lowering interest rates to zero did not spark a “bank lending spree” throughout the economy. Instead, the excess liquidity flowed directly back into the financial system, creating a global wealth gap, rather than supporting stronger economic growth.

The most vivid example of this “closed loop” was in corporate share repurchases. Corporations, able to borrow cheaply due to low rates, used debt and cash to repurchase shares to increase earnings per share. This was the easiest route to create “executive wealth,” rather than deploying capital in more risky endeavors. As the Financial Times penned:

“Corporate executives give several reasons for stock buybacks but none of them has close to the explanatory power of this simple truth: Stock-based instruments make up the majority of their pay and in the short-term buybacks drive up stock prices.”

Importantly, as noted by the Securities & Exchange Commission:

“SEC research found that many corporate executives sell significant amounts of their own shares after their companies announce stock buybacks.”

Again, buybacks may not be an issue, but when taken to excess such can have the negative side effects of inflating asset bubbles. As John Authers pointed out:

“For much of the last decade, companies buying their own shares have accounted for all net purchases. The total amount of stock bought back by companies since the 2008 crisis even exceeds the Federal Reserve’s spending on buying bonds over the same period as part of quantitative easing. Both pushed up asset prices.”

“Stock buybacks” are only a short-term benefit. With liquid cash, or worse debt, used for a one-time benefit, there is a long-term negative return on uses of capital for non-productive investments.

All Levered Up

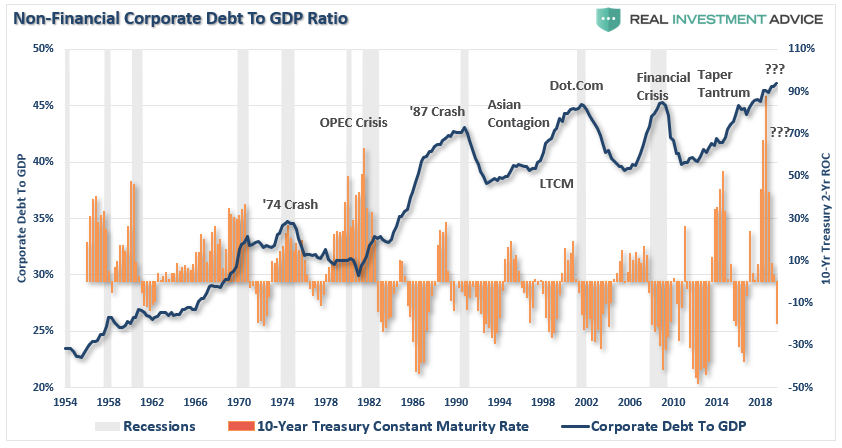

Currently, total corporate debt has surged to $10.1 trillion – its highest level relative to U.S. GDP (47%) since the financial crisis. In just the last two years, corporations have issued another $1.2 trillion of new debt NOT for expansion, but primarily used for share buybacks.

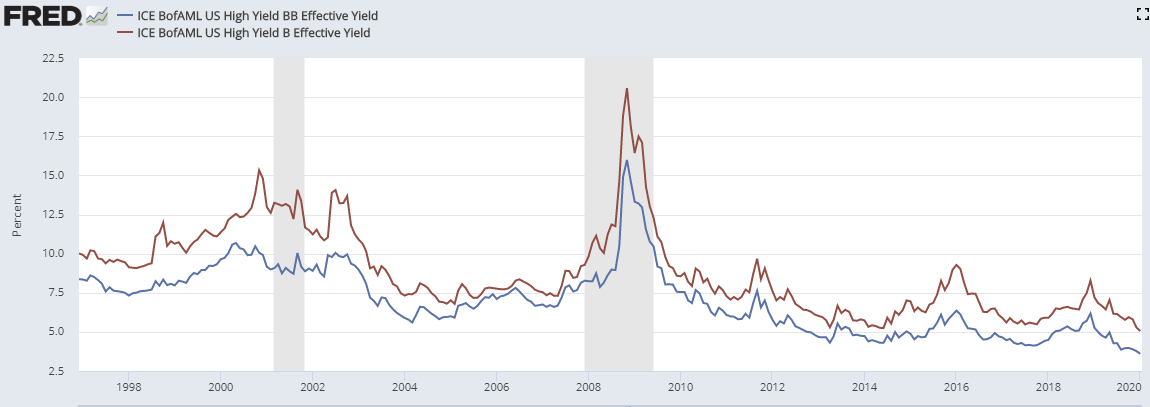

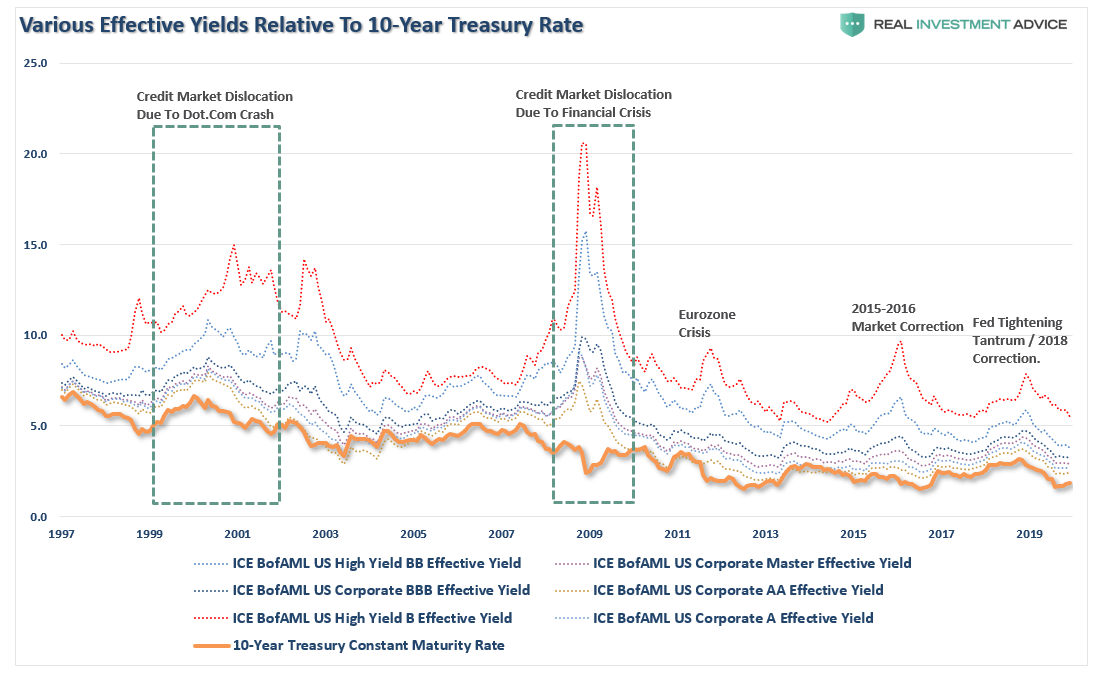

For the last 10-years, the Fed’s “zero interest rate policy” has left investors chasing yield, and corporations were glad to oblige. The end result is the risk premium for owning corporate bonds over U.S. Treasuries is at historic lows, and debt has allowed many “zombie companies” to remain alive.

During the next market reversion, the 10-year rate will fall towards “zero” as money seeks the stability and safety of the U.S Treasury bond. However, corporate bonds will be decimated. When “high yield,” or “junk bonds,” begin to default in large numbers, as they always do in a recession, which is why they are called “junk bonds,” investors will face sharp losses on the one side of their portfolio they “thought” was safe.

As the credit market falls into crisis, the Fed will have to ramp up additional stimulus to bail out the financial institutions caught long with an exceeding amount of poor-quality debt. As shown below, Treasuries will gain a bid as yields fall to zero, while corporate bonds lose value.

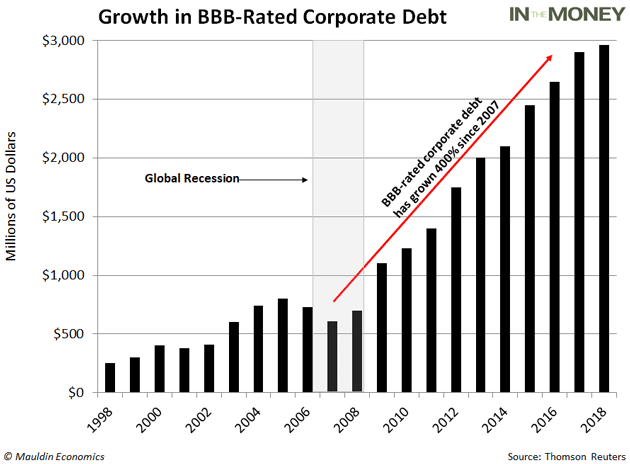

“In just the last 10 years, the triple-B bond market has exploded from $686 billion to $2.5 trillion—an all-time high. To put that in perspective, 50% of the investment-grade bond market now sits on the lowest rung of the quality ladder.

And there’s a reason BBB-rated debt is so plentiful. Ultra-low interest rates have seduced companies to pile into the bond market and corporate debt has surged to heights not seen since the global financial crisis.” – John Mauldin:

As noted previously, there is a large tranche of BBB bonds on the verge of being downgraded to “junk.” When this occurs, there will be an avalanche of selling as pension, mutual, and hedge fund managers dump bonds simultaneously into what will be an illiquid market.

Pensions Are Broke

But it is NOT just “share buybacks” and debt, which are problems hiding in plain sight.

“Moody’s Investor Service estimated last year that the total pension funding gap in the U.S. is $4.4 trillion. A few months ago, the American Legislative Exchange Council estimated it at nearly $6 trillion.”

With pension funds already wrestling with largely underfunded liabilities, the aging demographics are further complicating funding problems.

The $6 Trillion “Pension Crisis” is just one sharp market downturn away from imploding. As I wrote in “The Next Financial Crisis Will Be The Last:”

“The real crisis comes when there is a ‘run on pensions.’ With a large number of pensioners already eligible for their pension, the next decline in the markets will likely spur the ‘fear’ that benefits will be lost entirely. The combined run on the system, which is grossly underfunded, at a time when asset prices are declining, will cause a debacle of mass proportions. It will require a massive government bailout to resolve it.”

This $6 trillion hit is going to come at a time where the Federal Reserve will already be at “full tilt” monetizing debt to stabilize declining financial markets to keep a “debt crisis” from spreading.

Strike Three, You’re Out

While investors have become extremely complacent over the last decade that Central Banks have gained control of the financial markets, this is likely an illusion. There are numerous catalysts which could pressure a downturn in the equity markets:

- An exogenous geopolitical event

- A credit-related event

- Failure of a major financial institution

- Recession

- Falling profits and earnings

- A loss of confidence by corporations which contacts share buybacks

Whatever the event is, which is currently unexpected and unanticipated, the decline in asset prices will initiate a “chain reaction.”

- Investors will begin to panic as asset prices drop, curtailing economic activity, and further pressuring economic growth.

- The pressure on asset prices and weaker economic growth, which impairs corporate earnings, shifts corporate views from “share repurchases” to “liquidity preservation.” This removes a major support of asset prices.

- As asset prices decline further, and economic growth deteriorates, credit defaults begin triggering a near $5 Trillion corporate bond market problem.

- The bond market decline will pressure asset prices lower, which triggers an aging demographic who fears the loss of pension benefits, sparks the $6 trillion pension problem.

- As the market continues to cascade lower at this point, the Fed is monetizing nearly 100% of all debt issuance, and has to resort to even more drastic measures to stem selling and defaults.

- Those actions lead to a further loss of confidence and pressures markets even further.

The Federal Reserve can not fix this problem, and the next “bear market” will NOT be like that last.

It will be worse.

As John concluded:

Coordinated monetary policy is the problem, not the solution. And while I have little hope for change in that regard, I have no hope that monetary policy will rescue us from the next crisis.Let me amplify that last line: Not only is there no hope monetary policy will save us from the next crisis, it will help cause the next crisis. The process has already begun.” – John Mauldin

Geen opmerkingen:

Een reactie posten