The world's 10 richest people made $540bn in a year – we need a greed tax

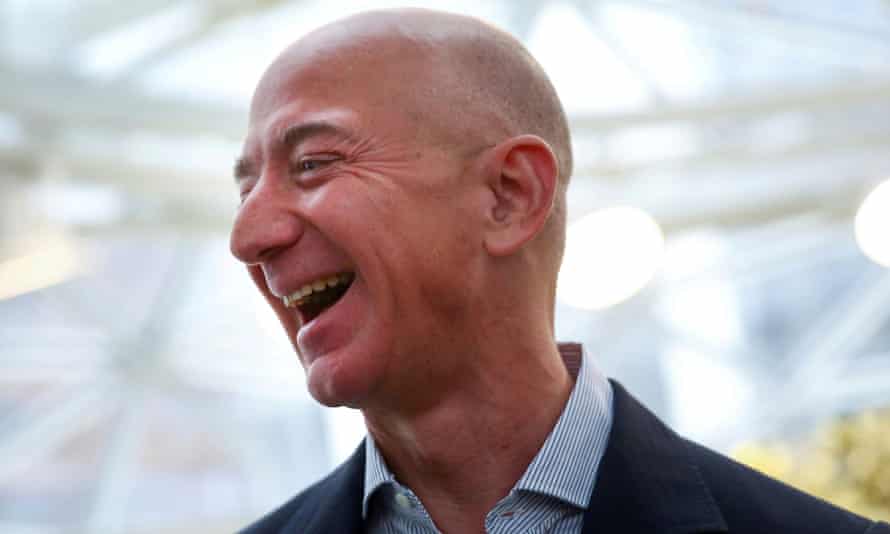

Jeff Bezos made $13bn in one day last year; and he’s not the only one getting rich during the Covid crisis. When are they going to be made to give some of it back?

$13,000,000,000. If all those 000s are making your eyes go funny, I’ll spell it out: thirteen billion. That’s how much Jeff Bezos added to his net worth in one day last July after the pandemic caused Amazon’s stock price to surge. Bezos’s $13bn (£10bn) payday set a record for the largest single-day increase in individual wealth ever recorded; however, he was far from the only billionaire getting that corona cash. According to a report by Oxfam, the combined wealth of the world’s 10 richest men has increased by $540bn since March 2020.

How much money is half a trillion dollars? Enough to vaccinate everyone in the world and ensure no one is pushed into poverty by the pandemic, Oxfam’s report, The Inequality Virus, claims. As for Bezos’s billions, Oxfam notes he could have paid all 876,000 Amazon employees a $105,000 bonus in September 2020 and remained just as wealthy as he was pre-pandemic.

Oxfam releases a report on inequality, timed to coincide with the Davos summit, every year. These often get a lot of press because Oxfam has nailed the art of condensing global inequality into a simple, shocking statistic. You’ve probably seen the stat from its 2019 report, for example, that the world’s richest 26 people own as much as the poorest 50%. But, as well as press, Oxfam’s reports also get pushback. Every year, the NGO gets accused of exaggerating and manipulating statisticsto stoke outrage. Every year, Oxfam calls for higher taxes on the wealthy and every year it is accused of being “obsessed with the rich”.

This year, however, capitalism’s usual cheerleaders are going to have a far harder time accusing Oxfam of catastrophising. The pandemic hasn’t just exacerbated inequality, it has made it impossible to ignore. It has also made getting on with “business as usual” tough. Governments around the world are facing enormous deficits; drastic action is needed to fix the economic damage caused by Covid.

If there is one upside to the pandemic, it’s that some ideas formerly dismissed as “radical” are now anything but. When Labour included free broadband in its 2019 manifesto, for example, the idea was ridiculed as “broadband communism”. The shift to remote learning demonstrated just how urgent closing the digital divide is: now thousands of UK households are being offered free high-speed broadband thanks to a partnership between internet providers and local authorities. Nobody’s calling it communism.

The idea of wealth taxes (levies on assets rather than income) is also gaining global momentum. Last December, Argentina passed a one-off “millionaire tax” to help the country recover from the pandemic. Bolivia’s leftwing government has passed a permanent wealth tax for the country’s richest residents. The British government has been urged to levy a one-off wealth tax on the value of household assets above £1m; economists say this would raise £260bn. Wealth taxes are also being pushed by progressive politicians in Germany and the US.

The idea that the rich should bail out the poor, who have been disproportionately hurt by the pandemic, is a no-brainer; it’s the only conscionable thing to do. However, when it comes to wealth taxes, I think we need to be careful about lumping people with assets above £1m in the same general category as people like Bezos, whose wealth can balloon by £10bn in a single day. There is a significant difference between millionaires and billionaires: the former should pay their fair share via a more progressive tax system; the latter shouldn’t exist. Billionaires aren’t just super-rich people, they’re policy failures. A system in which 10 men can see their collective wealth increase by half a trillion during a global crisis can’t be fixed with a one-off wealth tax – we need greed taxes that prevent people amassing that much in the first place.

• Arwa Mahdawi is a Guardian columnist.

Geen opmerkingen:

Een reactie posten