"Cashless" Sweden Suddenly Warns Citizens: Hoard Banknotes & Coins In Case Of Cyber-Attack Or War

For years, we have commented on the Swedish government and the Riksbank pushing for a “cashless society.”

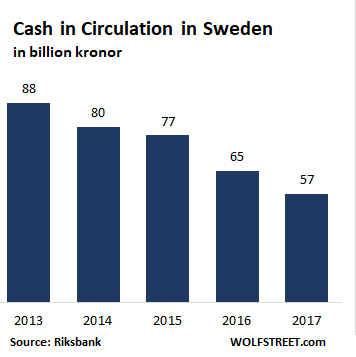

The Riksbank has over 1,000 articles posted on its website on the “cashless society“. The emphasis worked: between 2013 and 2017, the amount of cash in circulation dropped by 35%, earning Sweden a reputation as the world’s “most cashless nation”:

Many of Sweden’s bank branches had stopped handling cash altogether.

Figures from the Royal Institute of Technology in Stockholm show that only 18% of all payments made today in Sweden are in cash – a 15% drop from the previous year. Meanwhile figures from the Swedish Trade Federation show that most Swedish retailers say that 80% of their commerce is from card payments. A number that probably will be 90% by 2020. Such is the appetite for digital commerce in Sweden that many predicted it could become the world’s first cashless society.

But, now, as The Daily Mail reports, The Swedish Civil Contingencies Agency, an arm of the government, has sent guidance to every home telling residents to squirrel away “cash in small denominations” in case of emergencies ranging from power cuts or technology glitches to terrorism, cyber-attacks by a rogue government or war.

Riksbank, the country's central bank, last week called for an inquiry into the risks posed by a future cashless society.

Officials told parliament that hard cash was important "not just in times of crisis and war, but also in peacetime."

In December, Britain’s Access to Cash Review warned that Britain too was ‘sleepwalking into a cashless society’, the Daily Mail reported.

Chair Natalie Ceeney said, "If we don’t take action now in this country, we’re only a couple of years away from Sweden."

"Sweden’s big message to us is, 'Plan now before you get into a mess'.” Sweden hit its crisis when its equivalent of the NHS declared it was going cashless."

As the age of NIRP “gradually” comes to a close, much of the excitement about ushering in a cashless nirvana appears to be fading with it. Following on the heels of comments by senior ECB board members in defense of cashas well as an open admission by the European Commission that physical cash is perhaps not quite the source of all evil, the Riksbank’s decision to safeguard the role of cash in the financial economy is the biggest sign yet that Europe is giving up on its war on cash, and is instead allowing people switch to cashless payments systems at their own pace, however long that may take.

But now that the world's bankers are pivoting back to their dovish stance, how long before the return to NIRP (or ZIRP in the US) prompts a renwed war on cash?

Geen opmerkingen:

Een reactie posten