By John Helmer, Moscow

@bears_with

@bears_with

When Igor Kolomoisky (lead image, centre) financed anti-Russian units operating with the Ukrainian Army in the Ukrainian civil war, he was a staunch ally of Petro Poroshenko’s government in Kiev and the Obama Administration’s chief Ukraine policymakers, Secretary of State Hillary Clinton (left) and her Assistant Secretary for European Affairs, Victoria Nuland (right).

They in turn dominated the voting on the board of directors of the International Monetary Fund (IMF), led by managing director Christine Lagarde. Following the US regime change which installed Poroshenko’s regime in the spring of 2014, the IMF voted massive loans for the Ukraine to replace the Russian financing on which the regime of Victor Yanukovich had depended. More than a third of the fresh IMF money was paid out by the National Bank of Ukraine (NBU), the state’s central bank, into PrivatBank controlled by Kolomoisky and his partner, Gennady Bogolyubov.

At the time, investigations of Kolomoisky’s business and banking practices, and the special relationship he cultivated with the NBU, reported he was stealing the money through a pyramid of front companies lending each other the IMF cash which was not intended to be repaid. Clinton, Nuland, Lagarde and the IMF staff and board of directors ignored the evidence, as they continued to top up Kolomoisky’s pyramid. Criminal investigations by the US Department of Justice and the Federal Bureau of Investigation (FBI) were also reported at the time; they were neutralized by their superiors.

A new Delaware state court filing a month ago, triggering new US media reports, appears to signal a shift in US Government policy towards Kolomoisky. Or else, as some Ukrainian policy experts believe, it is a move by US officials to put pressure on the new Ukrainian President, Volodymyr Zelensky, whom Kolomoisky supported in his successful election campaign to replace Poroshenko.

In the new court papers, front company names and the count and value of US transactions between them, which PrivatBank has dug out of its own bank records, is published for the first time. But the scheme itself is not new. It was fully exposed in 2014-2015 in this archive. Nor is it news, as subsequent US media reports claim, that the FBI is investigating Kolomoisky and his US associates for criminal racketeering. The FBI investigation was first reported here.

What is missing is an explanation of why it has taken so long for the PrivatBank case against Kolomoisky to surface in the US courts and in the US press. Also missing is a list of the accomplices and co-conspirators in the scheme. These include officials of the IMF, the US and Canadian Governments who knowingly directed billions of dollars into the NBU, from which, as they knew full well at the time, the money went out to Kolomoisky’s Privat Bank, the largest single Ukrainian recipient of the international cash. At the top of the list of accomplices, immediately subordinate to Clinton, Nuland and Lagarde, are David Lipton, the US deputy managing director at the IMF, and the head of the IMF in Ukraine until 2017, Jerome Vacher.

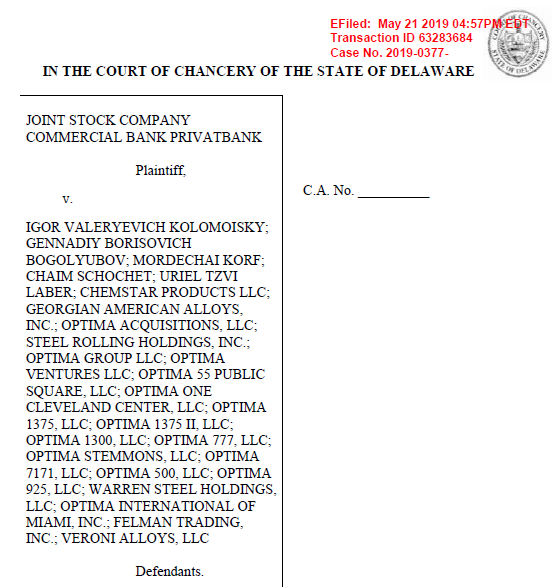

The plaintiff in the Delaware Court of Chancery is PrivatBank; it is represented by the Quinn Emanuel law firm of New York and Washington, DC.

In addition to Kolomoisky and Gennady Bogolyubov, his business partner and co-shareholder in the bank, three other individuals are named as defendants – Mordechai Korf, Chaim Schochet, and Uriel Laber. They are based in the US where they have run the US trading, production, management and investment companies which Privat now alleges were on the receiving end of the embezzlement from the bank and the onward money-laundering chain.

The story of Kolomoisky, Korf and Schochet was first reported in April 2015 here.

Left to right: Mordechai Korf; Chaim Schochet, Korf’s brother-in-law; and Uriel Laber. Because Korf, Schochet and Laber all live in Miami, the local newspaper has investigated some of their other schemes; here’s an investigation of the environmental damage of their manganese mine in Georgia. A catch-up investigation was reported by the Kyiv Postin May of this year.

The central allegation of the new court case is: “From at least 2006 through December 2016, the UBOs [Ultimate Beneficial Owners – Kolomoisky, Bogolyubov] were the majority and controlling stockholders of PrivatBank, one of Ukraine’s largest privately-held commercial banks. During that time period, the UBOs used PrivatBank as their own personal piggy bank—ultimately stealing billions of dollars from PrivatBank and using United States entities to launder hundreds of millions of dollars’ worth of PrivatBank’s misappropriated loan proceeds into the United States to enrich themselves and their co-conspirators.”

The racket – called the Optima schemes in the court papers after the names of several of the Delaware-registered companies used as fronts for moving the money into US assets – was this: “Through the Optima Schemes, the UBOs [Kolomoisky and Bogolyubov] exploited their positions of power and trust at PrivatBank to cause PrivatBank to issue hundreds of millions of dollars’ worth of illegitimate, inadequately-secured loans to corporate entities also owned and/or controlled by the UBOs and/or their affiliates (the “Optima Scheme Loans”). To facilitate and fraudulently conceal the Optima Schemes from discovery, the UBOs created and utilized a secretive business unit within PrivatBank’s operations (the “Shadow Bank”) to fund the fraudulent loans and launder those loan proceeds through a sophisticated money laundering process.”

“The stated purpose for each loan involved in the Optima Schemes was typically for financing the activities of the ostensible corporate borrower. The Optima Scheme Loans, however, were sham arrangements and the proceeds were not in fact used for that purpose. Instead, sometimes within minutes of being disbursed, the loan proceeds were cycled through dozens of UBO-controlled or affiliated bank accounts at PrivatBank’s Cyprus branch (“PrivatBank Cyprus”) before being disbursed to one of multiple Delaware limited liability companies or corporations (or other United States-based entities), all of which were [controlled by the UBOs].”

“In effect, the UBOs utilized a Ponzi-type scheme: old loans issued by PrivatBank would be ‘repaid’ (along with the accrued interest) with new loans issued by PrivatBank, and those new loans issued by PrivatBank would then be repaid with a new round of loans. The UBOs and their co-conspirators continuously carried out this process to conceal their frauds. Thus, proceeds from new PrivatBank loans were used to give the appearance that the initial PrivatBank loans (along with the accrued interest) were repaid by the borrower when in fact there was no actual repayment.”

“The proceeds from the new PrivatBank Ukraine loans were then laundered through various accounts at PrivatBank Cyprus to disguise the origin of the funds (i.e., a new loan from PrivatBank), and then used to purport to pay down the initial loans plus accrued interest. On paper, this appeared to be a repayment, but in reality, it was a sham and fraud, as PrivatBank was repaying itself and increasing its outstanding liabilities in the process. This process was carried out over and over again, over a period of many years, giving the appearance that PrivatBank’s corporate loan book was performing when, in fact, new loans were being continually issued to new UBO-controlled parties to ‘pay down’ the prior, existing loans. As a result, the size of the ‘hole’ in PrivatBank’s corporate loan book grew and grew, with each iteration of a loan plus interest being ‘repaid’ through the issuance of a new loan, which accrued interest itself before being ‘repaid’ through the issuance of yet a further new loan.”

Kolomoisky and Bogolyubov controlled PrivatBank from 2006 until it was taken over by the state in December 2016. The bank is alleging that Kolomoisky directed “the process of raising the loan exposure from UAH 27 billion (USD 5.3 billion) in December 2006 to UAH 195 billion (USD 8.1 billion) on December 31, 2015 (the Bank’s financial year end). During the same period, PrivatBank’s total liabilities relating to its customer accounts increased from UAH 24 billion (USD 4.8 billion) to UAH 192 billion (USD 8 billion).”

Arithmetically, the difference is $2.8 billion on the loan book, $3.2 billion on the balance-sheet. By the end of 2016, state bank auditors claimed there was “a $5.6-billion hole in [Privat’s] balance sheet caused by shady lending practices, with almost all of its corporate loans made to related parties.”

PrivatBank’s civil court complaint in Delaware runs to 104 pages. Read it here.

The bank is claiming the money was from “innocent Ukrainian citizens and businesses looking to protect their funds in a safe place at favorable deposit interest…at PrivatBank.” There is no mention of the funding from the IMF through the NBU, or from loans to Ukraine, also funneled through the NBU, by the US, the European Union, Canada, Japan, and the World Bank. Altogether, the IMF reports its transfers to Ukraine stood at the start of 2016 at $7.5 billion; other multilateral loans, together with loans from Canada, Japan, the US and other government sources amounted to $3.6 billion, according to IMF reports.

These foreign sources of cash were the deep pocket on which PrivatBank drew, with a share estimated by the NBU to have been one-third to 40% of the international inflow; in other words, at least $3.5 billion.

Most of the fresh evidence presented in Privatbank’s court papers has been gathered from Cyprus. There, according to the bank’s case, 41 front companies were used to move money. “Even though the Laundering Entities had billions of dollars moving in and out of their accounts, in reality, the entities had no business, assets, operations, or employees and were shell entities deployed for money laundering purposes.”

When the money was moved to the US, it was then spent on real estate – four commercial buildings in Cleveland, Ohio; two in Dallas, Texas; one in Harvard, Illinois – together with six ferro-alloy and steel production and trading companies operating in several US states. The court papers report the value of the real estate at acquisition at just over $287.5 million; the value of the metals companies, $468.7 million.

In addition, there were miscellaneous financial transfers with no clear end-purpose or investment target. “Based on information analyzed to date, Defendants laundered approximately $622.8 million worth of fraudulently obtained loan proceeds into the Optima Conspirators, including $188.1 million to Optima Group, $162.3 million to Optima Ventures, $153.7 million to Optima Acquisitions, $103 million to Optima International, $9 million to Warren Steel Holdings, and $6.7 million to Felman Trading. PrivatBank received no consideration in exchange for these transfers and the loans associated with the transfers were not repaid in full.”

Grand total, $1,379 million.

In another calculation, the bank case claims that “from January 2006 through December 2016, the total movement of funds (credits) into the UBOs’ Laundering Accounts at PrivatBank Cyprus was $470 billion, which amounts to approximately double the Gross Domestic Product of Cyprus during the same period.” A tabulation for the court of “Companies With The Largest Value of Transactions With Other Accounts at PrivatBank Cyprus” produces the sum total of money recycled at just over $200 billion. No evidence is presented that these sums were stolen by Kolomoisky & Co.

Instead, just two examples of “recycling” were presented by the bank’s lawyers. They add up to $44.6 million (million, not billion). The allegation is that “each of the above recycling schemes was intended to give the appearance that the initial PrivatBank loans were repaid by the indebted entities when, in fact, the UBOs and their co-conspirators were using proceeds from new PrivatBank loans to fund these repayments.”

The court papers don’t fix an amount the bank is claiming in repayment and damages. Instead, the bank asks for “compensatory damages in an amount to be determined at trial together with pre-and post-judgment interest as provided by law; or in the alternative providing Plaintiff with restitution… Awarding Plaintiff statutory damages, including treble damages; C. Awarding Plaintiff an accounting of Defendants’ assets derived from Defendants’ misconduct.”

Lawyers for the defendants are not commenting on the Delaware allegations. It can be anticipated that Kolomoisky will argue the Privatbank loans weren’t shams, and that they were repaid to the bank. Kolomoisky has already won counter claims against PrivatBank in courts in London and Kyiv; he is now negotiating with the Kiev government to recover a 25% stake in the bank. “We have always said that we are open to negotiations. We believe that we are the injured party, that we have been robbed,” Kolomoisky has told Reuters. “Kolomoisky calculates he is due a 25 percent stake in the bank because of the capital he had put into it. Give us then our 25 percent and keep 75, we will have a joint-stock company. There will be a 25 percent participation and 75 percent by the state, as one of the options.”

Reuters also reports the Ukrainian central bank and the IMF believe Privat “was used as a vehicle for fraud and money-laundering while Kolomoisky owned it, and said the government was forced to inject $5.6 billion of taxpayers’ money into the lender to shore up its finances.” For more detail, click to read this.

The work on the transactions detailed in the Delaware court papers was commissioned by PrivatBank and the NBU from Kroll, a due diligence firm as well known for white-washing the affairs of its clients as for investigating fraud. Kroll’s report was then leaked to Graham Stack. In his report, published on April 19, Stack concludes: “The money was moved through a PrivatBank subsidiary in Cyprus. The arrangement helped hide the fact that cash was disappearing because the National Bank of Ukraine treated the Cyprus branch of PrivatBank the same as it would domestic branches. This designation meant officials never detected that cash transferred to Cyprus was leaving Ukraine. Meanwhile, Cypriot regulators either failed to detect that the various bank transfers totalling $5.5 billion were backed by bogus contracts, or didn’t take the necessary action to stop them.”

The IMF’s staff head for Ukraine, Nikolai Gueorguiev, claimed that in March 2015 he had ordered “a new wave of bank diagnostics” to monitor related-party lending, liquidity and capital adequacy at PrivatBank; he was dissembling.

Stack (right) also reports Kolomoisky’s response to the Delaware case: “‘I categorically deny the allegations made by  the National Bank of Ukraine,’ Kolomoisky said, adding that regulators had all the access they needed to monitor his bank’s activities. He painted the authorities’ nationalization of his lending business as an asset grab. ‘Management of the [Ukrainian central bank] had as its main purpose not the support of the country’s largest bank, but its nationalization and the expropriation of the assets provided as security, together with the persecution and pressuring of the former shareholders,’ Kolomoisky said.”

the National Bank of Ukraine,’ Kolomoisky said, adding that regulators had all the access they needed to monitor his bank’s activities. He painted the authorities’ nationalization of his lending business as an asset grab. ‘Management of the [Ukrainian central bank] had as its main purpose not the support of the country’s largest bank, but its nationalization and the expropriation of the assets provided as security, together with the persecution and pressuring of the former shareholders,’ Kolomoisky said.”

Stack is an independent researcher and reporter of Ukrainian business and politics. Anders Aslund is an employee of Victor Pinchuk, a Ukrainian oligarch with bank, media and steel interests who has long been a rival of Kolomoisky’s. Aslund, a former Swedish government official, has worked for US think-tanks funded by Pinchuk. Aslund is now at the Atlantic Council in Washington, DC. The council lists Pinchuk’s foundation as having giving it up to $500,000 in financing for research, including Aslund’s pay. The US State Department, the British Foreign Office, and George Soros’s foundations are also listed as large donors.

Aslund (right) reported on the charges on June 4. Aslund claims to be reading about the stealing scheme for the first time.  “The money trail is surprisingly simple. To begin with, the ultimate beneficiary owners collect retail deposits in Ukraine by offering good conditions and service. The money then flows to their subsidiary, PrivatBank Cyprus. In Cyprus, they benefit from the services of two local law firms. Untypically, the ultimate beneficiary owners did not take the precaution to establish multiple layers of shell companies in Cyprus, the British Virgin Islands, and Cayman Islands, as is common among Russians with seriously dirty money. Instead, they operated with three US individuals in Miami, who helped them to set up a large number of anonymous LLCs in the United States, mainly in Delaware, but also in Florida, New Jersey, and Oregon.”

“The money trail is surprisingly simple. To begin with, the ultimate beneficiary owners collect retail deposits in Ukraine by offering good conditions and service. The money then flows to their subsidiary, PrivatBank Cyprus. In Cyprus, they benefit from the services of two local law firms. Untypically, the ultimate beneficiary owners did not take the precaution to establish multiple layers of shell companies in Cyprus, the British Virgin Islands, and Cayman Islands, as is common among Russians with seriously dirty money. Instead, they operated with three US individuals in Miami, who helped them to set up a large number of anonymous LLCs in the United States, mainly in Delaware, but also in Florida, New Jersey, and Oregon.”

Aslund expresses surprise that among Kolomoisy’s investments there were US ferro-alloy and steel plants and traders. “More remarkable is that Kolomoisky and Bogolyubov, according to the suit, purchased several ferroalloy companies in the United States, Felman Production Inc., in West Virginia; Felman Trading Inc. and Georgian Manganese, LLC; Warren Steel Holdings in Warren, Ohio; Steel Rolling Holdings Inc., Gibraltar, Michigan; CC Metals and Alloys, LLC, in Kentucky; Michigan Seamless Tubes, Michigan. These appear to be medium-sized companies in small places. Real people worked in these enterprises. Why didn’t anybody raise questions about the dubious owners?”

Aslund wouldn’t ask his question if he knew that Bogolyubov had until November 2016 operated Consolidated Minerals, a manganese mining company which has produced and shipped manganese ore and concentrates from mines in Australia and Ghana; and in the Ukraine, Bogolyubov and Kolomoisky have run the manganese refining plant called Nikopol. The fight between them and Pinchuk for that plant was reported here.

Aslund thinks the lesson of the new lawsuit is that “the United States allows the formation of hundreds of thousands of anonymous companies that have permeated this country with laundered money. The PrivatBank case shows that dirty money is not necessarily concentrated in the big cities and in real estate but can penetrate the real economy. The PrivatBank case provides a graphic illustration of the need to prohibit anonymous companies in the United States once and for all.”

This is what Pinchuk, a contender to recover the Nikopol plant and other assets from Kolomoisky if he is prosecuted in the US, is prompting Aslund to say. Pinchuk himself has been charged in the US courts with stealing and money-laundering schemes.

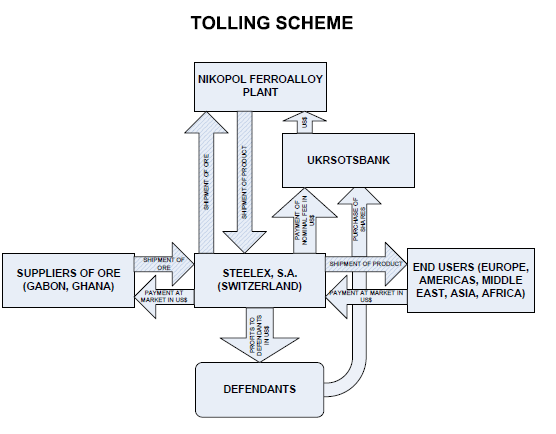

VICTOR PINCHUK’S STEALING SCHEME FROM NIKOPOL FERRO-ALLOY PLANT (2006)

Source: Igor Kolomoisky’s March 2006 racketeering lawsuit against Victor Pinchuk in US federal court in Massachusetts – read this.

Washington and Kiev sources add their suspicion that reviving the old charges against Kolomoisky is convenient for US officials seeking leverage of threatened prosecutions in the US to bend the newly elected Ukrainian government and Kolomoisky himself, deterring them from seeking a negotiated end to the civil war with the Kremlin. Identical US Government schemes have been run against former Ukrainian prime minister Yulia Tymoshenko and oligarch Dmitry Firtash; for those stories read this and this.

http://johnhelmer.net/the-kolomoisky-pyramid-started-with-hillary-clinton-and-victoria-nuland-of-the-state-department-plus-christine-lagarde-of-the-imf/

Geen opmerkingen:

Een reactie posten