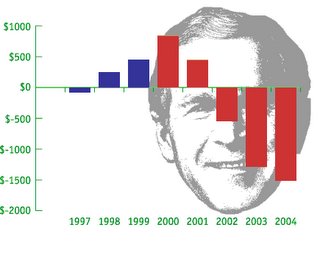

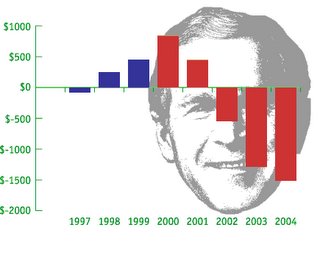

Na achttien jaar de voorzitter te zijn geweest van de 'Federal Reserve' gaat Alan Greenspan volgende week met pensioen, een failliet land achterlatend. Niet alleen de staat die nu de grootste buitenlandse schuld ter wereld heeft, maar ook de burgers, die alleen door leningen het hoofd boven water weten te houden. Net zoalang tot het systeem van lenen onvermijdelijk ineenstort. Alles en iedereen leeft er op de pof. Het is daarom ook interessant het portret te lezen dat de Washington Post van Greenspan schetste. Enkele citaten: 'U.S. household debt hit a record $11.4 trillion in last year's third quarter, which ended Sept. 30, after shooting up at the fastest rate since 1985, according to Fed data. · U.S. households spent a record 13.75 percent of their after-tax, or disposable, income on servicing their debts in the third quarter, the Fed reported. · The trade deficit for last year is estimated to have swollen to another record high, above $700 billion, increasing America's indebtedness to foreigners…The Fed chairman told Congress in June: "I think we've learned very early on in economic history that debt in modest quantities does enhance the rate of growth of an economy and does create higher standards of living, but in excess, creates very serious problems." Greenspan didn't define "excess," but economists see troubling possibilities: A sudden reversal in housing prices could trigger a recession if consumers cut back on spending and households have trouble paying their mortgages. The trade gap could swell to a point that forces a sharp fall in the dollar and surge in interest rates, also causing a recession…But low interest rates worked like an intoxicant on consumers, who snapped up new cars and trucks with no-interest loans and seized on low mortgage rates to buy new homes and refinance old home loans. Those sales and refinancings freed up more cash to spend. Households used much of that extra money to pay off credit cards, student loans and other, higher-interest rate debt -- "cleaning up their balance sheets," in economists' terms. They also kept shopping through the recession, the terrorist attacks and the rocky economic recovery that followed… Mortgage rates also fell, prompting homeowners to refinance repeatedly. Changes in the financial industry made it easier for homeowners to tap their home equity through refinancing. Lenders provided adjustable-rate mortgages that enabled home buyers to pay higher prices while temporarily making low monthly loan payments. The housing market kept booming. Consumer debt and spending kept climbing... And home values have skyrocketed, pumping up household wealth to a record $51 trillion in the third quarter, according to Fed data. But household debt rose faster in recent years than wealth or disposable income, reaching an unprecedented 126.1 percent of after-tax income in the third quarter, double its 1980 level… Indeed, U.S. households collectively spent more than their combined income in the second and third quarters of last year. The only way to do that is by selling assets, dipping into savings or borrowing.' Lees verder: http://www.washingtonpost.com/wp-dyn/content/article/2006/01/22/AR2006012201027.html?referrer=email&referrer=email&referrer=email

Na achttien jaar de voorzitter te zijn geweest van de 'Federal Reserve' gaat Alan Greenspan volgende week met pensioen, een failliet land achterlatend. Niet alleen de staat die nu de grootste buitenlandse schuld ter wereld heeft, maar ook de burgers, die alleen door leningen het hoofd boven water weten te houden. Net zoalang tot het systeem van lenen onvermijdelijk ineenstort. Alles en iedereen leeft er op de pof. Het is daarom ook interessant het portret te lezen dat de Washington Post van Greenspan schetste. Enkele citaten: 'U.S. household debt hit a record $11.4 trillion in last year's third quarter, which ended Sept. 30, after shooting up at the fastest rate since 1985, according to Fed data. · U.S. households spent a record 13.75 percent of their after-tax, or disposable, income on servicing their debts in the third quarter, the Fed reported. · The trade deficit for last year is estimated to have swollen to another record high, above $700 billion, increasing America's indebtedness to foreigners…The Fed chairman told Congress in June: "I think we've learned very early on in economic history that debt in modest quantities does enhance the rate of growth of an economy and does create higher standards of living, but in excess, creates very serious problems." Greenspan didn't define "excess," but economists see troubling possibilities: A sudden reversal in housing prices could trigger a recession if consumers cut back on spending and households have trouble paying their mortgages. The trade gap could swell to a point that forces a sharp fall in the dollar and surge in interest rates, also causing a recession…But low interest rates worked like an intoxicant on consumers, who snapped up new cars and trucks with no-interest loans and seized on low mortgage rates to buy new homes and refinance old home loans. Those sales and refinancings freed up more cash to spend. Households used much of that extra money to pay off credit cards, student loans and other, higher-interest rate debt -- "cleaning up their balance sheets," in economists' terms. They also kept shopping through the recession, the terrorist attacks and the rocky economic recovery that followed… Mortgage rates also fell, prompting homeowners to refinance repeatedly. Changes in the financial industry made it easier for homeowners to tap their home equity through refinancing. Lenders provided adjustable-rate mortgages that enabled home buyers to pay higher prices while temporarily making low monthly loan payments. The housing market kept booming. Consumer debt and spending kept climbing... And home values have skyrocketed, pumping up household wealth to a record $51 trillion in the third quarter, according to Fed data. But household debt rose faster in recent years than wealth or disposable income, reaching an unprecedented 126.1 percent of after-tax income in the third quarter, double its 1980 level… Indeed, U.S. households collectively spent more than their combined income in the second and third quarters of last year. The only way to do that is by selling assets, dipping into savings or borrowing.' Lees verder: http://www.washingtonpost.com/wp-dyn/content/article/2006/01/22/AR2006012201027.html?referrer=email&referrer=email&referrer=emailZoeken in deze blog 🔎🔎

maandag 23 januari 2006

Het failliete Amerika 5

Na achttien jaar de voorzitter te zijn geweest van de 'Federal Reserve' gaat Alan Greenspan volgende week met pensioen, een failliet land achterlatend. Niet alleen de staat die nu de grootste buitenlandse schuld ter wereld heeft, maar ook de burgers, die alleen door leningen het hoofd boven water weten te houden. Net zoalang tot het systeem van lenen onvermijdelijk ineenstort. Alles en iedereen leeft er op de pof. Het is daarom ook interessant het portret te lezen dat de Washington Post van Greenspan schetste. Enkele citaten: 'U.S. household debt hit a record $11.4 trillion in last year's third quarter, which ended Sept. 30, after shooting up at the fastest rate since 1985, according to Fed data. · U.S. households spent a record 13.75 percent of their after-tax, or disposable, income on servicing their debts in the third quarter, the Fed reported. · The trade deficit for last year is estimated to have swollen to another record high, above $700 billion, increasing America's indebtedness to foreigners…The Fed chairman told Congress in June: "I think we've learned very early on in economic history that debt in modest quantities does enhance the rate of growth of an economy and does create higher standards of living, but in excess, creates very serious problems." Greenspan didn't define "excess," but economists see troubling possibilities: A sudden reversal in housing prices could trigger a recession if consumers cut back on spending and households have trouble paying their mortgages. The trade gap could swell to a point that forces a sharp fall in the dollar and surge in interest rates, also causing a recession…But low interest rates worked like an intoxicant on consumers, who snapped up new cars and trucks with no-interest loans and seized on low mortgage rates to buy new homes and refinance old home loans. Those sales and refinancings freed up more cash to spend. Households used much of that extra money to pay off credit cards, student loans and other, higher-interest rate debt -- "cleaning up their balance sheets," in economists' terms. They also kept shopping through the recession, the terrorist attacks and the rocky economic recovery that followed… Mortgage rates also fell, prompting homeowners to refinance repeatedly. Changes in the financial industry made it easier for homeowners to tap their home equity through refinancing. Lenders provided adjustable-rate mortgages that enabled home buyers to pay higher prices while temporarily making low monthly loan payments. The housing market kept booming. Consumer debt and spending kept climbing... And home values have skyrocketed, pumping up household wealth to a record $51 trillion in the third quarter, according to Fed data. But household debt rose faster in recent years than wealth or disposable income, reaching an unprecedented 126.1 percent of after-tax income in the third quarter, double its 1980 level… Indeed, U.S. households collectively spent more than their combined income in the second and third quarters of last year. The only way to do that is by selling assets, dipping into savings or borrowing.' Lees verder: http://www.washingtonpost.com/wp-dyn/content/article/2006/01/22/AR2006012201027.html?referrer=email&referrer=email&referrer=email

Na achttien jaar de voorzitter te zijn geweest van de 'Federal Reserve' gaat Alan Greenspan volgende week met pensioen, een failliet land achterlatend. Niet alleen de staat die nu de grootste buitenlandse schuld ter wereld heeft, maar ook de burgers, die alleen door leningen het hoofd boven water weten te houden. Net zoalang tot het systeem van lenen onvermijdelijk ineenstort. Alles en iedereen leeft er op de pof. Het is daarom ook interessant het portret te lezen dat de Washington Post van Greenspan schetste. Enkele citaten: 'U.S. household debt hit a record $11.4 trillion in last year's third quarter, which ended Sept. 30, after shooting up at the fastest rate since 1985, according to Fed data. · U.S. households spent a record 13.75 percent of their after-tax, or disposable, income on servicing their debts in the third quarter, the Fed reported. · The trade deficit for last year is estimated to have swollen to another record high, above $700 billion, increasing America's indebtedness to foreigners…The Fed chairman told Congress in June: "I think we've learned very early on in economic history that debt in modest quantities does enhance the rate of growth of an economy and does create higher standards of living, but in excess, creates very serious problems." Greenspan didn't define "excess," but economists see troubling possibilities: A sudden reversal in housing prices could trigger a recession if consumers cut back on spending and households have trouble paying their mortgages. The trade gap could swell to a point that forces a sharp fall in the dollar and surge in interest rates, also causing a recession…But low interest rates worked like an intoxicant on consumers, who snapped up new cars and trucks with no-interest loans and seized on low mortgage rates to buy new homes and refinance old home loans. Those sales and refinancings freed up more cash to spend. Households used much of that extra money to pay off credit cards, student loans and other, higher-interest rate debt -- "cleaning up their balance sheets," in economists' terms. They also kept shopping through the recession, the terrorist attacks and the rocky economic recovery that followed… Mortgage rates also fell, prompting homeowners to refinance repeatedly. Changes in the financial industry made it easier for homeowners to tap their home equity through refinancing. Lenders provided adjustable-rate mortgages that enabled home buyers to pay higher prices while temporarily making low monthly loan payments. The housing market kept booming. Consumer debt and spending kept climbing... And home values have skyrocketed, pumping up household wealth to a record $51 trillion in the third quarter, according to Fed data. But household debt rose faster in recent years than wealth or disposable income, reaching an unprecedented 126.1 percent of after-tax income in the third quarter, double its 1980 level… Indeed, U.S. households collectively spent more than their combined income in the second and third quarters of last year. The only way to do that is by selling assets, dipping into savings or borrowing.' Lees verder: http://www.washingtonpost.com/wp-dyn/content/article/2006/01/22/AR2006012201027.html?referrer=email&referrer=email&referrer=email

Abonneren op:

Reacties posten (Atom)

The Jews Threatened the West and Still Do

Post Nieuwe posts bekijken Gesprek Tucker Carlson @TuckerCarlson · 5 u The Mike Huckabee interview, and the truth about America’s deeply u...

-

Juno Sara Alexandra, mijn kleindochter. Mag ik u voorstellen aan: Immanuel Maurice Wallerstein ( New York , 28 september 1930 ) een ...

-

Ziehier Yoeri Albrecht, die door een jonge journalist van het mediakanaal Left Laser betrapt werd tijdens een privé-onderonsje met twee ...

-

En weer een generatie joodse slachtofferisten, nu nog Israelische kinderen, die verwensingen schrijft op Israelische bommen die Libanese l...

Geen opmerkingen:

Een reactie posten